Adjustments

You may find it useful to start by looking at Accounting terms to ensure that you are familiar with the terms used here.

Why adjust an invoice?

In Case Manager an invoice cannot be changed except when it has draft status. And you set system settings to regulate changing your invoices, including preventing a change to draft status when the invoice has linked transactions (payments, etc) and preventing changes to journaled transactions altogether. These features protect the integrity of your data.

However, sometimes you do need to modify an invoice that you are unable to change. In these situations an adjustment must be created.

The adjustment is a transaction applied to the invoice. It has the effect of modifying the invoice without actually changing it because although the adjustment is linked to the invoice, it is a separate transaction.

If the invoice being adjusted is taxable, the tax adjustment is also calculated.

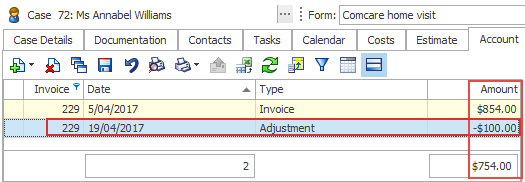

As shown below, an adjustment that reduces the invoice amount by $100 does not affect the invoice itself, but it reduces the amount that the company owes you for the invoice.

Types of adjustments

Two kinds of adjustment transactions can now be created.

- Adjustments to individual invoice line items (costs)

You can adjust each invoice line item individually, reducing each of them partially or fully. The tax is reduced at the correct rate for each line item.

The reductions will also be reflected in any estimate limits (e.g. Amount Left) and in cost-based reporting such as the Employee Charge Statistics. Tax reporting will also reflect the line item changes, which is important for accrual tax reporting.

This method is appropriate when specific line items in an invoice are disputed and need to be refunded. It is particularly useful for adjusting an invoice containing the work of multiple consultants or an invoice containing line items with different tax rates.

- An overall increase or decrease for the invoice total

You can adjust the total amount of the invoice, either up or down.

This adjustment is not linked to any particular invoice line items, so it does not alter any estimates or cost-based reporting. It simply allows you to either increase or decrease the invoice total. The adjustment has one overall tax rate that is used to calculate changes in the total tax.

Add adjustment

To create, edit or view adjustments for a case, select the case in the Case List and click its Account tab, see Add adjustment.

Older video demonstration of invoice total adjustments.