Add adjustment

The screenshots on this page do not all reflect the new web version yet.

Adjustments are created to modify invoices that cannot otherwise be changed. They effectively either increase or decrease the value of an invoice and can be applied to individual invoice line items.

Before adding an adjustment transaction in Case Manager it is important to understand how they function and when to create them, see Adjustments for details.

Add an adjustment

- At the case's Account tab select the invoice that needs adjusting.

- Click the New button

and select New Adjustment from the dropdown list.

and select New Adjustment from the dropdown list. - You are required to enter a reason for the adjustment in Notes.

- Select the tab for the type of adjustment you want to create.

- Follow the instructions at Adjust invoice line items or Adjust invoice total below.

- Click Save to save your adjustment.

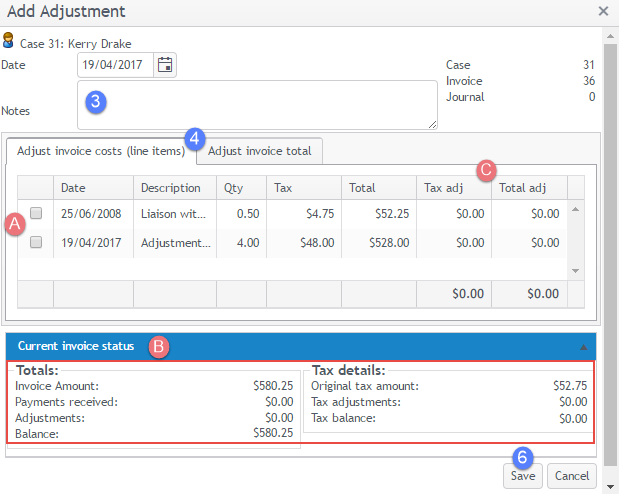

- You can see the line item details of the invoice that you are adjusting.

- If you click Current invoice status this opens a window showing more invoice detail and any payments and adjustments already made against the invoice. The information in this window is updated as you enter adjustment information.

Adjust invoice line items

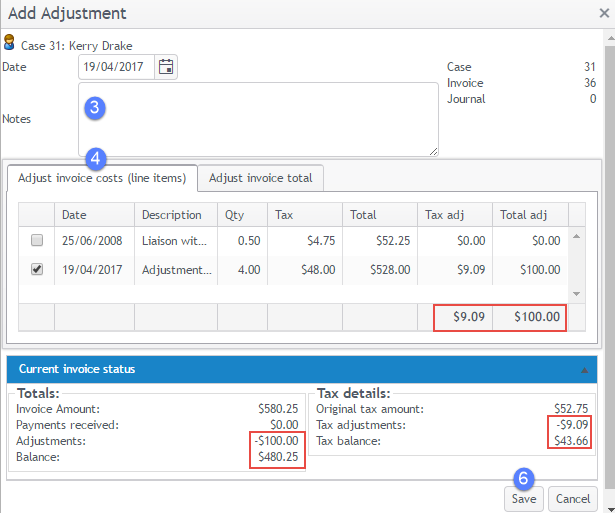

After clicking the Adjust invoice costs (line items) tab:

- Click the checkbox for a line item to fully reduce this line item so that its net cost is 0. The adjustment amount will be added at the Total adj column. You can change this amount if desired.

Alternatively, you could simply add the reduction amount for the line item at its Total adj column.

You can repeat step 5 for multiple line items in the invoice.

As you enter information you will see updated totals at the Tax adj and Total adj columns (C). Remember that with this type of adjustment the reduction in tax is calculated per adjusted line item.

As you enter information you can also see updates to the invoice details window if you have opened it.

- Click Save to save your adjustment.

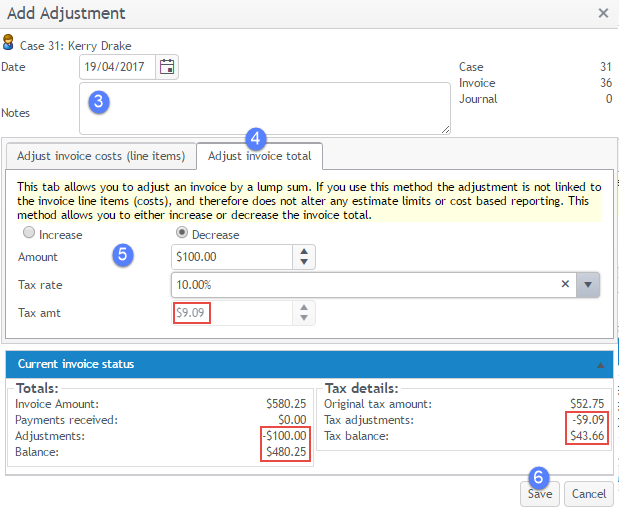

Adjust invoice total

After clicking the Adjust invoice total tab:

- Select an increase or decrease option as appropriate and enter the adjustment amount.

- Click Save to save your adjustment.

This adjustment has a single tax rate.

When the invoice contains line items that all have the same tax rate, this rate is applied to the adjustment.

When the invoice contains a mixture of taxed and un-taxed line items, you can select the tax rate to apply to this adjustment. You can only select a tax rate that applies to at least one invoice cost.

The amount of tax adjusted is calculated automatically.

As you enter information you can also see updates to the invoice details window if you have opened it.