ReturnToWorkSA charge code rounding

The screenshots on this page do not all reflect the new web version yet.

ReturnToWorkSA requires that when activities are invoiced their duration per charge code per day must be a multiple of 6 minutes.

Why charge code rounding?

The idea is that a short activity need not be given a minimum 6 minute duration.

Instead of rounding each cost entry up to your minimum charge interval (i.e. 6 minutes), you record the duration of each cost using the actual number of minutes taken. Daily costs are then combined together with equivalent activities into multiples of 6 minutes.

For example, two 3 minute phone calls for the same case on the same day do not each have to be rounded up to 6 minutes but are combined together to make a total of 6 minutes in one day.

As another example, the following costs are added to a case on one day:

- 2 minute activity with charge code WR220

- 5 minute activity with charge code WR220

- 2 minute activity with charge code WR220

The daily total for charge code WR220 at the end of this day is 9 minutes, which is rounded up to a multiple of 6 minutes, i.e. 12 minutes.

This rounding has certain advantages and effectively reduces the minimum charge interval to one minute. However, compliance with the system can be difficult to achieve because you may have to make modifications to your costs, see the Challenges below.

Case Manager's charge code rounding

Case Manager offers two options to help you manage the ReturnToWorkSA requirement:

- You enter costs using the actual, non-compliant amounts of time.

- You can group specified charge codes together so that they are considered to be the same charge code for this rounding.

When the costs are invoiced, they are checked and changed if necessary to make the total per charge code per day into a multiple of 6 minutes. This means that creating an invoice may mean also mean increasing costs.

For example, with the three costs shown above, at invoicing the third cost is increased to 5 minutes, so that the total per charge code on this day is 12 minutes.

Note that Case Manager does not do the rounding when you create the costs because you might later enter other costs on the same day with the same charge code.

Set options

These options are set at a category level in the category accounting settings and this setting must be saved in the windows version of Case Manager. Once set, the web version can perform the necessary calculations.

In the windows version select Lists > Other Lists from the main menu and select Category from the List Type dropdown list. Select the category and its settings tabs appear at the bottom half of the screen.

Click the Accounting tab and then click the WorkCover SA tab (WorkCover SA is the old name for ReturnToWorkSA).

- Click the checkbox to require that costs for cases with this category are rounded up, as described above, when they are invoiced.

- Enter equivalent charge codes in the list, separated by commas.

Challenges requiring intervention

The charge code rounding system described above works well, however there are some situations where you have to intervene:

- Rounding up would make costs exceeds the estimate limit

- Rounding up is prevented by a system setting

The rounding up is done at invoice time and this can sometimes create a system error because the modified cost now exceeds the estimate limit.

As a result, the invoice cannot be created without increasing the estimate.

A solution is to examine the separate entries for the same charge code over separate days and see where you can make small adjustments yourself.

As a very simple example: you billed 8 minutes of an activity one day and 3 minutes the next day. The estimate limit is 12 minutes of this activity.

However, when you try to create an invoice from these costs they must be rounded up to 12 and 6 minutes each, giving a total of 18 minutes. This exceeds the estimate, so the invoice cannot be created:

A solution is to intervene and manually change both costs to 6 minutes. This would be reasonably accurate and also compliant both with ReturnToWorkSA and the estimate limit. You could then create the invoice without problems.

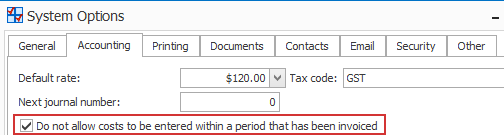

If you are creating invoices within a period that you have previously invoiced and you have the following system setting switched on, you will get an error message:

This is because the rounding up, in effect, tries to add a cost within an invoiced time period, which you have specified that you want to prevent. The solution is to turn off this setting temporarily while you create the invoices.