Transfer journal entry into accounting software

Integrating Case Manager with your accounting software depends on the particular software you use. Full integration is available with Xero and you can export your invoices to MYOB. For the other accounting software packages the instructions below for transferring journal entry data should apply.

Review of concepts

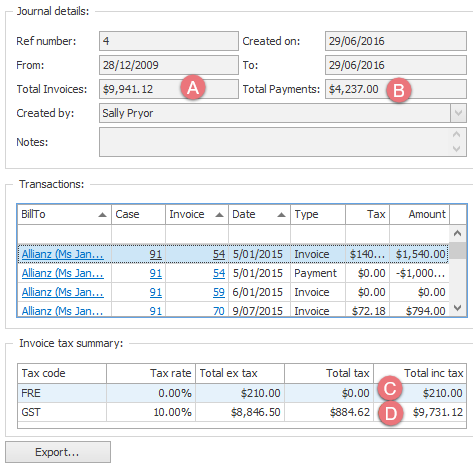

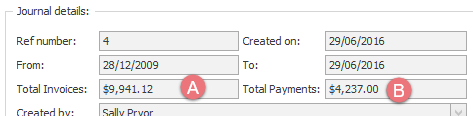

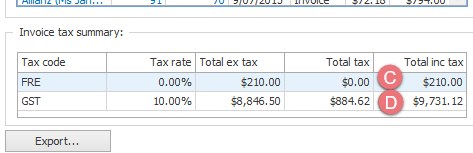

First, let's remind ourselves that a journal entry summarises and regulates specified accounts transactions. You can choose to include invoices, adjustments, payments and/or refunds. The top third of the journal displays the journal details, including summaries for total invoices (A) and total payments (B). The middle third lists the accounts transactions included. The bottom third displays the tax totals included in the invoices and adjustments (C and D).

Remember that once a transaction has been journaled it will be locked, depending on the value of a system setting, see Changes to journaled transactions.

Second, looking at a typical business it:

- receives income: you send out invoices and you receive money to pay them

- generates expenditure: other businesses send you invoices and you give money to pay them

As you probably realise, Case Manager can manage income but it does not manage expenditure.

The accounts transfer method that you should use depends on whether your business does accrual or cash accounting:

- Cash accounting: this is when cash changes hands.

You are tracking the money you received and the money you spent. Thus, only cash payments and receipts are recognised, not invoices or bills.

On the income side Case Manager can report on the payments received (highlighted) against the Case Manager invoices you sent out.

- Accrual accounting: this is when invoices are raised

You are tracking revenues and expenses when they are accrued, regardless of whether the actual cash has been received or paid out. Accruals represent money that you expect to earn and to pay out. Thus, you are tracking the invoices you send out to customers and the invoices that you receive from suppliers.

On the income side Case Manager can report on the Case Manager invoices sent out (highlighted).

Third, for either accounting method you can start by creating a customer in your accounting package called Case Manager Debtors.

All the accounts summary information derived from Case Manager journals is entered against this customer. In effect, it is a proxy in your accounting software representing all your customers in the Case Manager database. These customers are your debtors because you invoice them for your services. They owe and (ideally) will pay you money.

Cash accounting transfer

This system tracks money received for sales, so only payments (and refunds) entered in Case Manager need be transferred to your accounting software.

To transfer the payment data create a journal and specify that only payments be journaled (at step 2 of create journal entry). Then follow the steps below.

Create a sales receipt in the accounting software

- Select the Case Manager Debtors customer.

- Enter the journal entry number as the sale number.

- Enter the journal entry date as the sale date.

- Enter the amount of the payments in the sales line item.

| CM journal entry | Accounting software |

| journal entry number | sale number |

| journal entry date | sale date |

payment total (B) | sales line item |

Note the assumption here is that your accounting program can calculate your tax and assume that all invoices include tax. If this is not true, you should calculate your GST/VAT data accurately using the Case Manager report instead, see GST and VAT.

Accruals accounting transfer

This system tracks invoices sent so the total invoice value needs be transferred to your accounting software, separated into taxed and untaxed totals.

In your accounting software you create an invoice for each Case Manager journal entry. The invoice records all that you billed in the journal.

Before adding your first invoice we suggest that you create two list entries in your accounting software: one for taxable and one for non-taxable services. For each one, you must specify an account and tax code.

To transfer the invoice data create a journal and specify that only invoices and adjustments be journaled (at step 2 of create journal entry). Then follow the steps below.

Create an invoice in the accounting software

- Select the Case Manager Debtor customer.

- Enter the journal entry number in the invoice number field.

- Enter the journal entry date into the invoice date.

- Enter the taxable and non-taxable totals from the journal on two separate lines.

| CM journal entry | Accounting software |

| journal entry number | invoice number |

| journal entry date | invoice date |

invoice taxable total | taxable total |

invoice non taxable total | non taxable total |

Create a payment in the accounting software

Depending on whether you record payments in Case Manager or in the accounting software, you may also want to transfer payments and refunds. If so, you can create a payment (receipt) in your accounting software that records all that you received.

To transfer the payment data create a journal and specify that only payments be journaled (at step 2). Then follow the steps below.

- Select the Case Manager Debtor customer.

- Enter a CR prefix followed by the journal entry number into the payment ID number.

- Enter the journal entry date as the payment date.

- Enter the journal entry's payment total as the amount received.

| CM journal entry | Accounting software |

| CR + journal entry number | payment ID number |

| journal entry date | payment date |

payment total (B) | amount received |

Select the oldest Case Manager Debtor invoice(s) in your accounting software and apply this payment. Since each journal entry can represent transactions for many Bill To companies, it is unlikely that the amount received will exactly match the invoice total(s). Any unpaid amount outstanding represents all of your debtors in Case Manager grouped together.

How often to create the journal

Every business should makes its own decision. Some factors to consider are:

- You could create a journal entry when invoice runs are completed, either weekly, fortnightly or monthly.

- You may decide to create the invoice & adjustment journal entry more frequently to keep your accounting package more up-to-date.

- A journal could be created at the end of your accounting period. You should create a journal entry for all invoice and adjustment transactions entered in that period.

- You may want to create separate journal entries for invoices (including adjustments) and payments if you perform separate transfers into an accounting package.

- Every time you deposit cheques into your bank account you could create a journal entry containing the payment transactions for the cheques you banked.

You would have a single payment entry in your accounting system that corresponds with the entry on the statement issued by your bank and simplifies bank reconciliation.

If a journaled transaction changes

Sometimes you need to change transactions after they have been journaled. Case Manager has two options to regulate this and hence keep your data synchronized, see Changes to journaled transactions.