Integrate with Xero: invoices

Batches of invoices can now be exported to Xero in a simple integration process:

- Create a journal entry that includes the required invoices.

- Click Export at the bottom of the journal entry.

- Select the Xero export options and export the invoices.

- Examine the export log and address any issues it identifies.

Full details of the process are at Export invoices to Xero.

A Case Manager invoice is created in Xero as a draft invoice, with full line item detail and CM- added to the invoice number. Line items are exported as tax-inclusive figures, using the tax code mapping described below.

Xero organises transactions by contact name. This is the equivalent of the invoice contact's company name in Case Manager.

Case Manager prevents you re-exporting an invoice if it has already been exported to Xero.

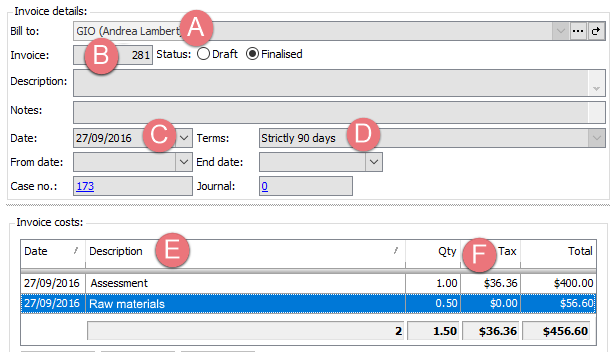

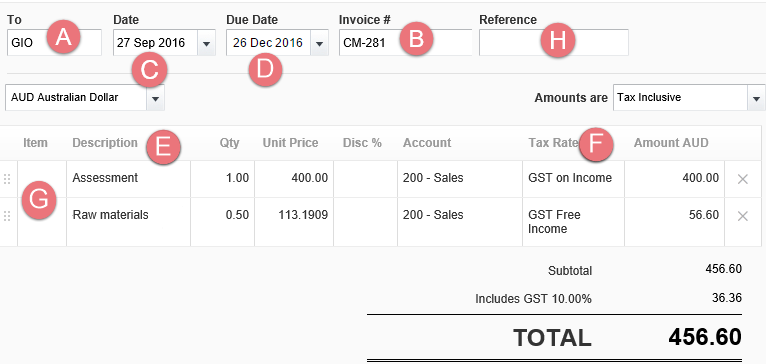

Invoice mapping between the two systems

Below is an invoice in Case Manager and the exported invoice in Xero.

- A Xero contact name is the equivalent of the invoice contact's company name in Case Manager.

- Case Manager invoice numbers are imported into Xero with CM added at the beginning.

- The invoice date is the same for both.

- The Case Manager invoice terms are used to set the due date for the Xero invoice.

Where the invoice contact's company has no name, the export uses the contact’s name. You can specify whether you want the surname listed first, see Select export options.

- The standard export uses the cost's name to create the Xero line item description.

- Case Manager tax codes are mapped into their Xero equivalents, see table below.

- If desired the Xero Inventory item code can be set to the cost's charge code, see the export options.

- The Xero invoice's Reference field can contain one or more Case Manager fields, see the export options.

You can customise this to also include the cost's date, notes and/or charge code, see the export options.

Tax code mappings

Case Manager tax codes are converted in Xero as follows:

| Case Manager | Xero | Additional notes |

| GST | GST on Income | |

| FRE | GST Free Income | |

other tax code | other tax code | When an invoice line item has another tax code, the name of this tax code is used in the export. This tax code must be defined as a tax code in your Xero database for Xero to calculate the correct line item tax amount. |

Notes

- It's fairly safe to experiment while you learn to use this procedure because invoices are brought into Xero as draft invoices which you can delete easily.

- Make sure that the Case Manager company names are spelled the same as Xero’s contact names. If a name is spelled differently or if it doesn't already exist in the Xero system, Xero will assume it's a new contact and create it.

- The API invoice integration described above is set up to send invoices to one Xero account only.

If you need to send invoices to more than one Xero account, see the information at Multiple companies and Xero integration.