Accounting terms in Case Manager

Overview

When work is done on a case or an item or service is purchased these expenses are recorded as costs in the case. This is a supervised process that may involve adhering to an estimate for the case. Costs provide the foundation for invoices.

Accounting transactions

Case Manager offers four types of accounting transactions:

- invoices

- payments

- adjustments

- refunds

Invoices and payments

The first type, invoices, are a fundamental part of billing companies for costs. You create invoices for your cases in Case Manager.

Payments record the receipt of funds to pay these invoices. Most cases contain payment transactions, depending on whether you process payments in Case Manager or in another accounting program.

The last two types of transactions, adjustments and refunds, are used less frequently in Case Manager. They have the net effect of changing invoices or payments that cannot otherwise be modified, such as when needing to change journalled invoices or payments.

If we look at a very simple case's Account tab we can see all four types of transactions:

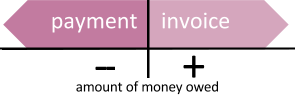

We can also see that the total amount of money owed to you for the case is at the bottom. This is the net amount owed to your business for this case.

We can also see above that:

- an invoice increases the amount owed to you

- a payment decreases the amount owed to you

Note that payments are displayed as a negative number in this tab because they decrease the amount of money owed to you. Naturally they are actually received by your business as positive amounts of money.

We also notice that:

- each of these accounts transactions is linked to an invoice or is itself an invoice

- invoices and adjustments can include tax

- payments and refunds do not include tax

- when a transaction reduces the amount of money owed to you, the amount is shown in red

[however don't forget that some invoices may not include tax because not all costs are taxable]

Adjustments and refunds

An adjustment changes the amount of an invoice that cannot otherwise be modified. If the adjustment is negative (as is often the case), this effectively reduces the invoice amount and hence decreases the amount owing to you. In contrast a positive adjustment does the opposite. Adjustments also affect the tax total(s).

So invoices and adjustments are tightly coupled.

Similarly payments and refunds are tightly coupled. They both record the actual transfer of money, either to your business (payments) or from your business (refunds). They are both tied to an invoice and there is no tax involved.

A refund effectively changes the amount of a payment that cannot otherwise be modified. It is usually associated with an adjustment, through its invoice number.

The classic use of a refund is to remedy an overpayment, such as when a paid invoice is adjusted downwards for some reason, which leaves you owing money to the bill payer. This is remedied by transferring funds to them and it is entered in the system as a refund.

For more detailed information about such scenarios see Correcting accounting errors.

Example

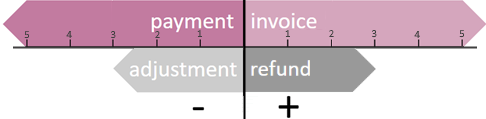

The diagram below shows a scenario where the adjustment reduces the cost of a fully paid invoice.

The invoice has been paid in full (top LHS) and the adjustment effectively reduces the cost of the invoice (bottom LHS).

The refund (bottom RHS) equals this reduction (in the opposite direction) and records the transfer of those funds back to the bill payer. The end result is that the invoice is balanced and nothing is owed for it.

If you return to the simple case in the screenshot at the top of the page, you can see a similar situation:

- a fully paid invoice of $864 was reduced by $200, i.e. adjusted by -$200

- this necessitated a refund and return of $200 to balance the account.

Accounts information at the Case List

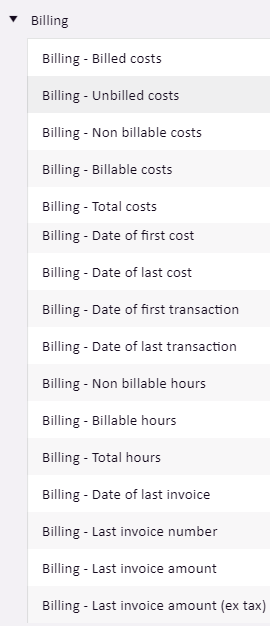

Further accounts information can be displayed as columns in the Case List:

For definitions of these terms see Detailed billing information.