Accounts

Simple overview

When a case worker does work on a case or an item or service is purchased for a case, these expenses are recorded as costs in the case. This is a supervised process that may involve adhering to an estimate for the case.

Costs provide the foundation for invoices that are usually sent to the case contact with the Bill To role. When payment is received it is entered against appropriate case invoice(s).

Adjustments may be made to invoices if required and refunds entered.

The last step is integration with systems outside Case Manager. Examples are accounting systems such as Xero and regulations such as GST. The process involves first creating journal entries that summarise and regulate accounts transactions.

Note that another form of integration can occur immediately after invoice creation. This is invoice integration with certain agents, which makes the payment process faster and more streamlined.

Overall, the billing process involves:

- recording costs (which may be subject to estimates)

- creating invoices from these costs

- receiving payments for these invoices

- if necessary, making adjustments to invoices and creating refunds against payments

- summarising and regulating accounting transactions with Accounts integration

- integrating with systems outside Case Manager via journal entries

You will find it useful to look at Accounting terms in Case Manager to familiarise yourself with the basic terms used in the system.

At the case level

To view the details of all costs in a case select its Costs tab. To view the details of all estimates in a case select its Estimate tab.

To view the details of all the accounting transactions in a case (invoices, payments, refunds and adjustments) select its Account tab.

Invoices

There are two ways to create invoices:

- create an invoice for an individual case at its Account tab, see case invoice for details.

- create a batch of invoices for the entire business within specified criteria (e.g. for a particular creditor) using the invoice generator.

You can use both methods interchangeably as required.

In a large business accounts are typically restricted to specialised staff. You can limit access to accounting information and functions by restricting staff access to accounting functions, see Security groupsfor more information.

The role of lists

The category of a case is tremendously important and, along with company of each invoice contact, determines many accounting options and functions for the case. Importantly, categories are linked to sets of customised charging options via the Activity List and the Charge Code List. This simplifies recording costs and controls the billing process. Once these lists have been set up to suit your business they can save users a great deal of time and you can be sure that certain rules are always enforced.

Detailed billing information

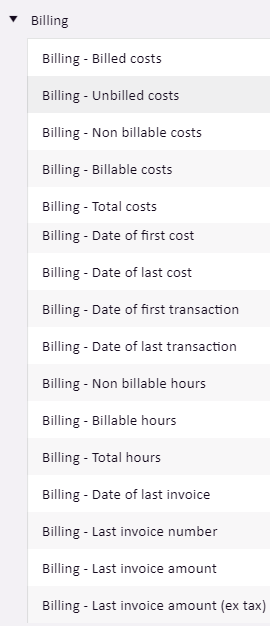

You can view further billing details for a case by selecting appropriate columns in the Case List Criteria and looking at your case in the Case List.

Billing fields

- Unbilled costs: the total of all costs that have not been invoiced

- Billed costs: the total of all costs that have been invoiced

- Billable costs: the total of unbilled and billed costs

- Non billable costs: costs that are not billed

- Total costs: the total of billable and non billable costs

You can also look at appropriate Reports.