Journal entries

When you create a journal entry in effect you take a snapshot of specified transactions that also 'locks' them, see Changes to journaled transactions below.

There are several options for a journal entry. You can include some or all of: invoices, adjustments, payments and refunds.

The journal entry itemises the transactions included in it and displays summaries of:

- the total for any invoices and adjustments included

- the total for any payments included

- the tax totals for any invoices and adjustments included

In Case Manager the journal entry method is often also used to export accounting information to accounting software such as Xero and MYOB.

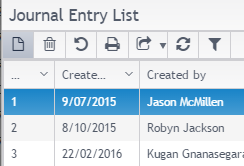

Journal Entry List

To access the Journal Entry List select View > Journal Entry List from the main menu .

On the left of the screen the list displays existing journal entries. The list can be managed using standard grid functions, see List tools for details.

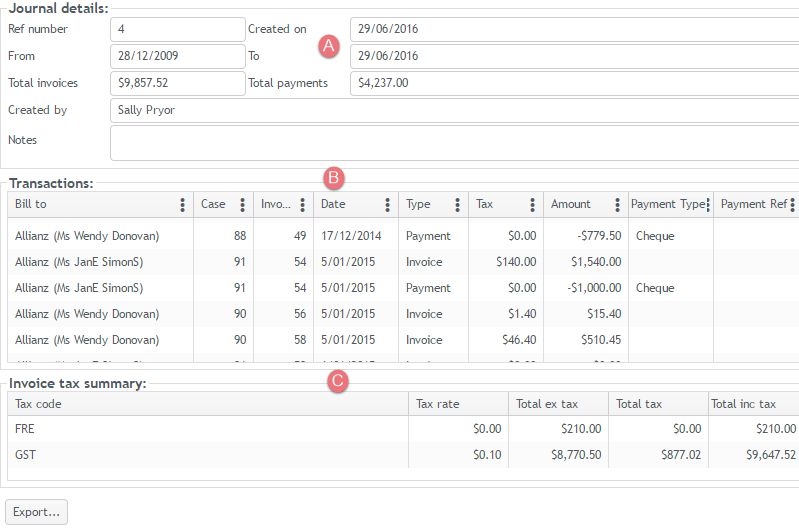

Journal information

The currently selected journal entry is displayed on the right of the screen.

- The top part displays the journal details, including summaries for Total Invoices (this includes adjustments) and Total Payments.

- The middle part displays a list of the transactions included in the journal entry, with information such as the type of each transaction, including the payment type for payment transactions.

- The bottom part displays the tax totals for transactions included in the journal entry.

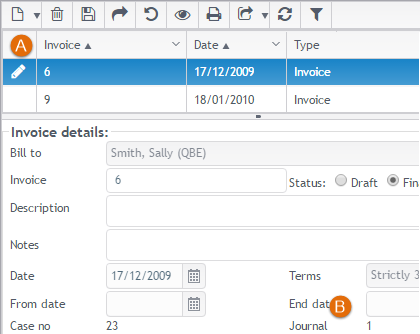

When a journal entry has been created Case Manager records that each of its transactions has been journaled. This is indicated for the transaction at its case's Account tab. There is an icon in the grid (A), and the journal number can seen in the grid if required. The journal number is also shown in the transaction details (B).

Once you have created the journal entry it is simple to integrate Case Manager with your accounting software by entering journal totals into the software, see Transfer journal entry into accounting software for instructions or importing the journal contents into MYOB or Xero. You also use journal entries for GST / VAT reporting.

Changes to journaled transactions

Journaled transactions should be considered 'frozen' so they are regulated in Case Manager. However, sometimes you may need to make a change that affects an existing journal entry, for example if you need to delete a journaled invoice.

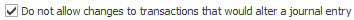

There is a system option that offers ways to manage the situation. Select Tools> Options from the main menu and click the Accounting tab, see Accounting settings.

You can choose whether to lock journaled transactions or not:

Lock journaled transactions

This is the recommended method.

If you check the option above, all transactions that have been journaled, i.e. included in a journal entry, are locked and cannot be subsequently modified. Case Manager prevents anyone changing transactions that have been included in a journal entry. This has two advantages:

- If you are using journal entries to synchronise Case Manager with your accounting package, you can be sure that the two remain synchronised.

- Once you have paid GST to the ATO, it is important that these invoices are not modified in any way.

If an invoice needs to be changed (due to a bad debt write-off or a disputed service) you should make an adjustment to correct the issue rather than modifying the invoice. An adjustment to the invoice is a new transaction and will be included in the next journal entry.

Don't lock journaled transactions

If you do not check this option you are permitting authorised users to change journaled transactions.

When you modify or delete a journaled transaction, Case Manager automatically adjusts the journal entry it was part of. You are warned that your journal entry is affected and advised to locate the corresponding entry in your accounting software and adjust it to match the new value(s). This helps ensure that your accounting data is synchronised with Case Manager but it is more risky than preventing changes altogether.