Refunds

The screenshots on this page do not all reflect the new web version yet.

You may find it useful to look at Accounting terms to ensure that you are familiar with the Case Manager accounting terms used here.

Why create a refund?

In Case Manager a refund effectively reduces a payment that cannot otherwise be modified. There is no need to create a refund when there has been no payment against an invoice.

A refund is an accounting transaction that records money being (or about to be) transferred from your business.

Thus, it is associated with a payment, an invoice and usually also an adjustment. These accounting transactions - payments, adjustments and refunds - are connected together via the invoice number that they are linked with.

Refunds are applicable when, for example, a paid invoice is found to have overcharged or when a company overpays its invoice. See Correcting errors for full details of how to handle such scenarios.

Refunds

Like payments, there is no tax involved in a refund. Also like a payment, a refund records the actual transfer of funds, by cheque, bank transfer, etc.

A refund records money transferred from your business to the bill payer. Thus, a refund is the opposite of a payment which records that money moved to your business from the bill payer.

You may already have noticed that you enter payments as positive amounts. Case Manager lists the payment transactions with a negative value because they reduce in the amount owed by the bill payer.

Similarly you enter any refunds as a positive amount. Case Manager lists the payment transactions with a positive value because they increase the amount owed by the bill payer.

Thus, the net result of a refund is an increase in the amount owed by the bill payer. This is usually needed in order to address issues such as the overcharging in the example below.

Order of transactions

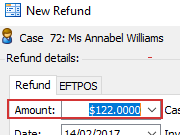

When you create a refund, Case Manager automatically enters a refund amount that would balance out the linked invoice.

Where this is a nonsense value (i.e. a negative number), the amount starts at zero.

This auto-balancing saves time when you have entered the other accounting transaction(s) in order. These are the transactions that make the refund necessary. The auto-balancing indicates the amount that is probably required.

However, this amount will be incorrect if you create the relevant transactions out of order. You can correct the refund amount, but you lose the extra security provided by the system check. So it is good practice to create a refund as the final step of an accounting process, unless there is a reason for not doing so.

Example

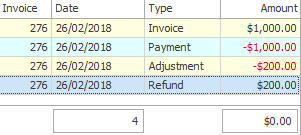

As an example, a paid and journalled invoice for $1000 is found to have overcharged by $200. You returned $200 to the bill payer and need to record this in the system and make sure that their account balances.

- Add an adjustment of -$200 to reduce the effective amount of the invoice

- Then add a refund to record the money moving out of your account.

The refund form will start off with the amount set to $200, which balances the invoice and is the correct amount.

| invoice | 1000 |

| payment | -1000 |

| adjustment | -200 |

| refund | 200 |

Net value of invoice Net paid for invoice Net balance for invoice | $800 $800 $0 |

Note that if you add the refund before the adjustment, the refund amount would start off set to $0 because the invoice was already balanced. Of course you could still change it but you lose extra security provided by the system check.

Add refund

To create, edit or view refunds for a case, select the case in the Case List and click its Account tab, see Add refund.