GST and VAT

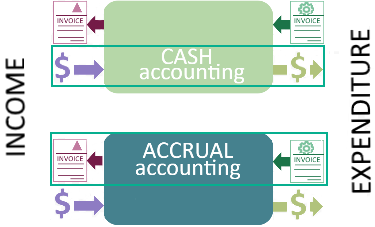

To understand tax reporting we will start with a very simple model of business accounts.

In a typical business there is:

- income: you send out invoices and you receive money to pay them

- expenditure: other businesses send you invoices and you pay them

Accounting methods

There are two main methods of business accounting and the method you use for tax reporting depends on whether your business does accrual or cash accounting:

- Cash accounting: this is when cash changes hands.

- Accrual accounting: this is when invoices are raised. Accruals represent money that you expect to earn and to pay out.

Thus, you are tracking money received and money spent. Cash receipts and payments are reported, not invoices or bills.

Thus, you are tracking the invoices you send and the invoices that you receive. Revenues and expenses are reported when they are accrued, regardless of whether the actual cash has been received or paid out.

As you probably realise, Case Manager can manage income but it does not manage expenditure.

So Case Manager can provide a summary of the tax you collected in a certain period. You should obtain information about tax you paid using the software that you use to manage accounts payable.

Calculating the tax you collected

If you use cash accounting, you need to calculate the tax included in payments received against invoices you sent out.

If you use accrual accounting you need to calculate the tax included in the invoices you have sent out.

For both methods, there are two approaches to calculating this:

| Use Case Manager | Run the appropriate tax report, see the details below. |

| Use your accounting package | Transfer the details from Case Manager into your accounting package so that you can produce tax reports there. The transfer process usually involves creating a journal entry, see Integration with accounting software. |

Using Case Manager to calculate tax

For cash accounting, after you enter payments into Case Manager, you can report how much income you received, including the tax you collected within this income.

For accrual accounting, Case Manager can report on the total value of the invoices sent to customers and the tax included in these invoices.

With both systems, you should regulate the transactions included in the tax calculations so that they cannot be changed later. The journal entry provides a method to do this. When you create a journal entry this collects a set of transactions and regulates them. It itemises the transactions included in it and displays summaries of:

- the total for any invoices and adjustments included

- the total for any payments included

- the tax totals for any invoices and adjustments included

Once a transaction has been journaled it will be locked, depending on the value of a system setting, see Changes to journaled transactions. And in each case's Account tab, an icon indicates that the transaction has been journaled.

Note that if you later make an adjustment to a journaled invoice, the adjustment will be a new transaction and so any change to your GST payable will be included on the next journal entry and next GST calculations.

Cash accounting in Case Manager

With cash accounting you need to calculate the tax included in payments you received for invoices. To do this run the Tax Cash standard report by selecting View > Reports from the main menu.

This gives a summary of tax paid (e.g. GST, VAT) for a specific date range for each tax period, either monthly or quarterly depending on how you registered as a business.

There is an option to report on different time frames; other filters include category, employee, team and office.

You should also run a journal entry with exactly the same specifications so that you regulate the transactions involved in your tax calculations.

Note that this report accommodates the situation where a partial payment is received for an invoice containing both taxed and tax-free services. For example, if one third of such an invoice was paid, the tax is calculated as one third of the total tax. When the remaining two thirds payment is received, the remaining two thirds of the tax is included in the next tax report. Overall, all the tax for the invoice is collected and reimbursed to the ATO (or equivalent), which is what they require of you.

Accrual accounting in Case Manager

With accrual accounting you need to calculate the tax included in invoices you billed. To meet your GST/VAT reporting requirements using Case Manager, create a single journal entry for each tax period, either monthly or quarterly depending on how you registered as a business. Naturally you should include both invoices and adjustments in this journal.

The journal entry provides summary figures of total invoices and total tax collected that you can enter into your BAS.

You may choose to also run the Tax Accrual standard report by selecting View > Reports from the main menu. This gives a summary of tax paid (e.g. GST, VAT) for a specific date range. There is an option to report on different time frames (i.e. quarterly, monthly, yearly or a custom range.) Other filters include category, employee, team and office.

GST calulations and rounding

GST calculations for invoices can use one of two methods:

- In the line item approach GST is calculated per line item.

- In the total invoice approach the GST is 1/11th of the invoice total. This method assumes that there are no tax-free line item costs in the invoice.

When the invoice line item's GST has more than 2 decimal places, it is rounded to whole cents (2 decimal places), depending on your system's Midway Rounding setting.

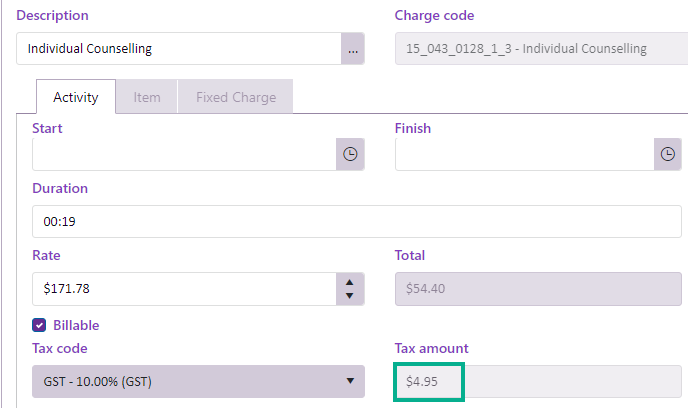

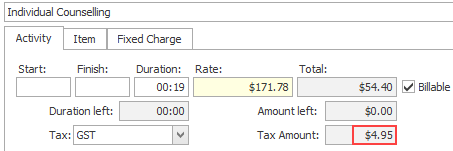

The tax for each invoice line item is added to calculate the total GST for the invoice and the tax is displayed for each cost item.

Case Manager uses this method.

When the invoice total's GST has more than 2 decimal places, it is rounded up to whole cents (2 decimal places).

Both methods are approved by the ATO, as this extract from their media release states:

In some situations the two methods produce slightly different GST values because of the effects of cumulative rounding.

For example, below, the total of $54.40 is divided by 11. The GST is 4.945454545454545... This was rounded to 2 decimal places and became $4.95:

When each line item's GST is added to calculate the total GST this may not exactly match the value calculated using the total invoice method.

If you do need your invoices to use the total invoice method, this can be done in a custom invoice layout. Contact our Support team to ask about this.

If you need further information, follow this link from the ATO.