Accounts integration

The screenshots on this page do not all reflect the new web version yet.

The accounts information in Case Manager can be integrated with outside systems.

There are three types of integration:

- Invoice integration with agents, such as WorkCover Queensland.

- Integration with accounting software, such as Xero

- Integration with tax institutions, such as GST / VAT

Journalled invoices are exported to a file and imported directly into the agent's payment portal. This saves a great deal of time and speeds up payment.

Invoices and payments can be passed between the two systems.

There are several methods to calculate the required tax figures.

First step

The first step for each option is usually the creation of a journal entry collect specified accounts transactions. You can choose to include invoices, adjustments, payments and/or refunds.

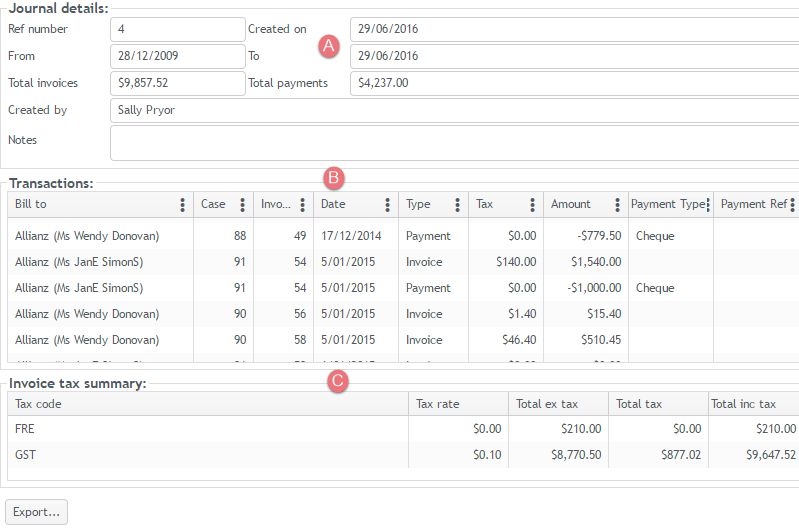

- The top part of the journal displays the details, including summaries for any invoices and adjustments included at Total Invoices and any payments included at Total Payments.

- The middle part displays a list of the transactions included.

- The bottom part displays the tax totals for any invoices and adjustments included in the journal entry.