Costs overview

When a case worker does work on a case or an item or service is purchased for a case, these expenses are recorded as costs in the case.

Every cost in the system is linked to a case and to an employee.

Costs provide the foundation for invoices. Usually you enter the cost details as they are incurred and then create invoices from the costs at a later date.

Each case has a Costs tab where you can see a list of all the costs linked to this case and whether they have been invoiced.

When you add the cost you are usually choosing from activities linked to the case's category. This is a supervised process that may involve adhering to a case estimate, which further limits the activities available at the case.

Costs and invoices

A cost can be edited if it is an unbilled cost, i.e. it has not already been invoiced. If it has been invoiced but the invoice has draft status, you can edit the cost from within the invoice.

If a change needs to be made to an invoiced cost you can make an adjustment against the invoice at the Account tab.

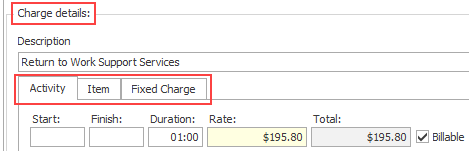

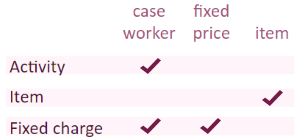

A cost is one of three types of charges:

- Activities performed by a case worker, such as a consultation or writing a report.

- Items such as a piece of equipment

- Fixed charges for work performed by a case worker where a flat fee is charged, for example an initial assessment.

Total cost = time spent X hourly rate

These costs are time-based. You record the time spent. This is multiplied by the hourly rate to calculate the final cost.

Total cost = number of items X item cost

You record the quantity of the item. This is multiplied by the unit cost to calculate the final cost.

These include products (e.g. a back support) or fixed price services (e.g. a gym program).

Item costs are also used for other charges that are passed on through your business, such as doctors' bills.

Total cost = fixed charge

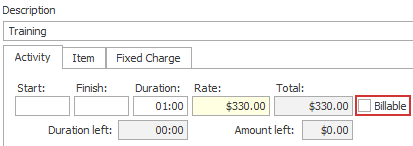

You do record the time spent but do not be confused, this does not affect the cost. The information is only used to monitor the time taken to actually do the work.

Note that you can only add the full fixed cost to a case; it's not possible to add a portion of a fixed cost, even though you do record the time spent.

Thus when applied to a cost in a case, the total is calculated either by:

- multiplying a charge rate by duration (i.e. the amount of time)

- multiplying an item cost by a number or units

- adding a fixed charge

You can see examples of calculating the total costs at Cost rates.

Note that when you see the word activity in Case Manager outside of a cost's Charge details area, it usually refers generally to all types of potential costs. For example, we say that the Activity List contains activities, which are potential costs of all three types.

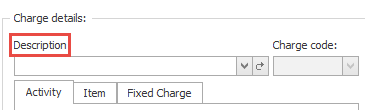

To enter a new cost click the New button ![]() in the Costs tab then select a value from the Description dropdown list.

in the Costs tab then select a value from the Description dropdown list.

The charge options that are available to select from in the Description dropdown list were previously set up in the Activity List. Each member of the Activity List is linked to one or more categories. So the category of the case for which the new cost is being entered (along with any estimates applied to the case) determine which charge options are available to select.

The selection of a charge option determines important aspects of the new cost: its type (activity, item, etc), its rate, often its charge code (when set at the Activity List by choosing from options created in the Charge Code List), and so on. Typically this charge option selection sets non-negotiable aspects of the cost, depending on whether estimate(s) apply to the case and what is specified at the case's category. You can't change the type of cost or (usually) its charge code. However, you can change other details, such as charge rates (subject to your permissions).

There are four ways to enter costs (see below) however each method ultimately involves the same screen, see Add cost for details.

There are four ways to add a cost to the system:

- add a cost to a case in its Costs tab

- add a cost to a case document via the Documentation tab

- add a cost to a case at your employee time sheet

- add a cost to a draft invoice

Some consultants recommend using only method 2: linking every cost to a document, such as an email, a word file or a PDF file. With case work that does not involve a document, this approach means creating a brief note in the case's Documentation tab and adding the cost to the document. The idea is that this method makes it easy to supply audit information whenever required.

However there are other ways to record audit information, such as using the Notes field for a cost, and you can use these costs methods interchangeably as best suits your business.

Note that a cost added using one method is visible to the other methods, where appropriate. For example, when an employee links an activity cost to a case document, this adds an entry in the Costs tab and an entry in the employee’s time sheet.

For activity and item costs the total cost is calculated by multiplying the quantity (time or number of units) by a rate per hour or per item.

This multiplication occurs when the cost is added to the case. The total cost is first rounded to two decimal places and then stored.

See Rounding for further details.

A non billable cost is one where the Billable setting has not been checked. This should be set at the Activity List.

Such costs can be added to a case but will never be included in invoices. Thus, these costs are recorded in the system but are not billed.

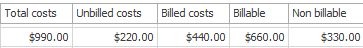

The Case List Criteria provides several columns with case billing information, including the following totals:

- Unbilled costs: the total of billable costs that have not been invoiced

- Billed costs: the total of billable costs that have been invoiced

- Billable costs: the total of unbilled and billed costs

- Non billable costs: the total of costs that will not be billed

- Total costs: the total of billable and non billable costs in the case

Below is an older video demonstration of the different methods of adding a cost.