Settings

When considering the settings that affect accounts, we start by reviewing the three-level model for settings in case Manager.

Review

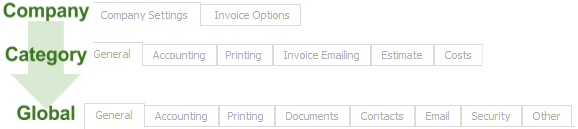

Case Manager is an extremely customisable system and you can often customise settings at three levels:

- the Bill To company of the case

- the category of the case

- the global system settings for your business

Often you only need to customise a setting for a company or category when you want cases/invoices with this company or category to be handled differently from what would otherwise apply, i.e. from what is specified in the system settings.

This process works because when settings at different levels apply to the same operation there is a hierarchy, A company setting usually overrides the case category setting, which overrides the global system setting.

An example of this hierarchy in action is invoice templates. When applying the template for an invoice, the system looks at its invoice contact. If an invoice template was defined for the invoice contact's company, then this template is applied to the invoice. If not, the system searches for an invoice template for the case’s category and uses that. If such a template does not exist either, the system uses the global invoice template.

The diagram below shows the hierarchy and indicates the range of settings tabs at each level.

Settings that affect accounts

Thus, the accounts settings are at three levels:

- Settings at the company level:

- Company settings

- Invoice options

- Settings for the category of the case:

- Accounting

- Invoice Printing,

- Invoice Emailing

- Estimate

- Costs

- Global system settings for your business:

- Accounting

- Invoice Printing

- Other

Note that company-level invoice options are derived from the invoice contact's company. This is usually, but not necessarily, the Bill To case contact's company. Pre-invoice settings such as the hourly rate are derived from the case Bill To contact's company.

Whether a statement is required.

You can specify that for cases with a certain Bill To contact's company the hourly rate for Activity costs is standard, discounted, increased (premium) or fixed. This rate does not apply to items or fixed charge costs types. This applies when adding costs at the Costs tab, timesheet or to an estimate.

Note that this setting can be disabled at the category level if the ignore specific company rates checkbox is ticked at its Costs tab (see below).

Includes company-specific invoice terms and notes, restriction of the permission to create invoices at a case, templates for accounting transactions and invoice email options.

Includes rate, charge code, tax code, invoice terms and notes, restriction of the permission to create invoices at a case, office and employee provider numbers

Templates for accounting transactions

Invoice email options

These are detailed at entering costs and Estimates settings.

This is detailed at entering costs and Estimates settings.

Includes rate, tax code, invoice terms and notes

Invoice templates and invoice email templates

How far in advance date values for costs, invoices, etc can be entered.

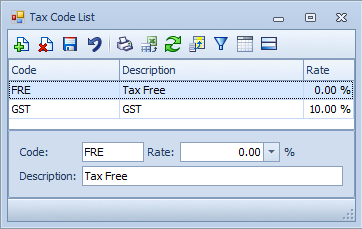

Set tax rate

The tax rate is set globally in the Tax Code List.

To find this select Lists > Tax code List from the main menu.

In this list you can change the rate if the government decides to increase or decrease the relevant rate.

You can create your own tax codes here, eg. for VAT.