Integrating with accounting software

The screenshots on this page do not all reflect the new web version yet.

As you have seen, you can manage accounts receivable transactions for your cases without leaving Case Manager. This includes producing invoices, tracking payments and creating invoice adjustments or payment refunds when required.

You will also learn later in the Reports module that accounting reports, such Overdue Accounts or GST collected, are also available in Case Manager.

However, you may run a separate accounting package and hence, you will need to integrate your Case Manager accounting data with this package so that you can produce reports such as Profit & Loss, Balance Sheet or a full GST report.

The first step in any integration is the creation of a journal entry.

Journal entries are used to summarise and regulate accounts transactions over specified periods of time, such as quarterly. You can choose to include invoices, adjustments, payments and/or refunds in one journal.

Journal entries are created and managed at the Journal Entry List, which you can access by selecting View > Journal Entry List from the main menu.

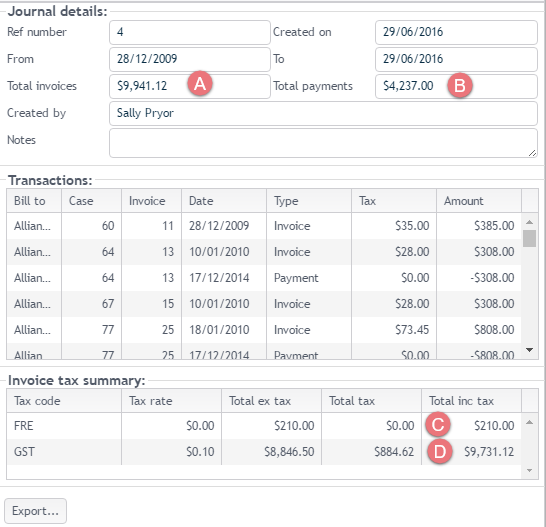

The top third of a journal displays the journal details, including summaries for Total Invoices (A) and Total Payments (B) The middle third displays a list of the accounts transactions included. The bottom third displays the tax totals included in the invoices and adjustments, separated into totals including tax (C) and totals that are tax-free (D).

A journal entry has the ability to ‘lock in’ transactions associated with it. This ensures that no user can change a transaction that has been included in a journal entry. To set this in your system select Tools> Options from the main menu and select the Other tab to locate the setting.

This is important because:

- If the journal entry is being used to synchronise Case Manager with an accounting package, it ensures that the two stay synchronised.

- Once GST/VAT has been paid to the Tax Authority, it is important that the transactions involved are not modified.

Note

- If an invoice does need to be changed (a bad debt write-off or a disputed service), an adjustment transaction can be created to correct the issue. This will be included in the next journal entry and in the next tax reporting period and ensures all figures are accurate.

- If you do not enable the journal locking option above and users are permitted to edit transactions included in a journal entry, make sure that a hard copy is printed for each new journal entry.

If an invoice is subsequently deleted, Case Manager will warn that the journal entry is affected and it automatically adjusts the journal entry to reflect the change.

There are different methods for this:

- Accounting transactions can be integrated with Xero or MYOB.

- You may choose to manually enter invoices, adjustments, payments and refunds into your accounting package.

- You may choose to manually export invoices and manually enter adjustments, payments and refunds into your accounting package.

- Alternatively, you can manually enter journal summaries into your accounting software as described below.

We will not cover this here but you can find full information in the rest of this site at Integrate Xero and Export to MYOB.

The exact transfer method depends on the package involved. However, the method below should apply to most GST/VAT compliant packages.

First create a new customer in your accounting package that represents all your summarised journal information as one customer. Call it something like Case Manager Debtors. This is a proxy representing all your Case Manager customers as one debtor that you invoice for your services. The debtor owes and (ideally) pays you money.

There are different transfer methods depending on whether your business does accrual or cash accounting. If you are unsure about the meaning of these terms, you can find information in the rest of the site at GST and VAT.

Only payments (and refunds) need be transferred to your accounting software. Thus, when creating the journal entry, you can specify that only payments be journaled.

For each journal go to your accounting package:

- Select the Case Manager Debtors customer.

- Use the journal entry number as the sale number.

- Use the journal entry date as the sale date.

- Enter the amount of the payments in the sales line item.

Note that if your accounting program calculates your tax it makes the assumption that all work being paid includes tax. If this is not true, you should calculate your GST/VAT data accurately using Case Manager reports instead, see below.

The invoices totals need be transferred to your accounting software. Thus, when creating the journal entry, you can specify that only invoices and adjustments be journaled. Depending on whether you record payments in Case Manager or in the accounting software, you may also want to transfer payments and refunds.

In the accounting package you will create invoices recording all that you billed in each journal and possibly payments recording all that you received.

Before adding the first invoice, create two list entries. Under Time Billing, create two new activities for journal transfer: one for taxable and one for non-taxable services. For each one, specify an account and tax code.

For each journal go to your accounting package and create an invoice:

- Select the Case Manager Debtor customer.

- Use the journal number for the invoice number.

- Use the journal date for the invoice date.

- Enter the taxable and non-taxable totals from the journal on two separate lines.

You may also create a payment (receipt):

- Select the Case Manager Debtors customer.

- Enter the ID number as CR followed by the journal number.

- Use the journal date for the payment date.

- Enter the payment total from the journal Entry as the payment amount received.

- Select the oldest invoice(s) to apply the amount paid.

Since each journal entry represents many transactions, it is unlikely that the amount received will match the invoice total. Any amount outstanding represents the total debtors in Case Manager.

At the end of each tax period, records of the total GST/VAT figures need to be calculated. In Australia this is required for the Business Activity Statement (BAS).

Case Manager can tell you the amount of tax you have collected. It does not track accounts payable.

Once again, there are different calculations depending on whether your business does accrual or cash accounting, details are at GST and VAT.

- If you do cash accounting, after you enter payments into Case Manager the Tax Cash report can tell you how much income you received, including the tax you collected within this income.

- If you do accrual accounting, the Tax Accrual report calculates the total value of the invoices sent to customers and the tax included in these invoices.

Alternatively you can calculate all GST/VAT data in your accounting package after you have transferred the required information from Case Manager.

Note that if an adjustment is subsequently made to an invoice, any change to GST/VAT payable will be included on the next reporting period.

You will find more detailed information about accounts integration in the rest of this site, starting at Accounts integration.

After you do the quiz you have completed the Accounting module. In the next module you will learn how workflows can assist you to manage cases successfully.

Next: Quick quiz